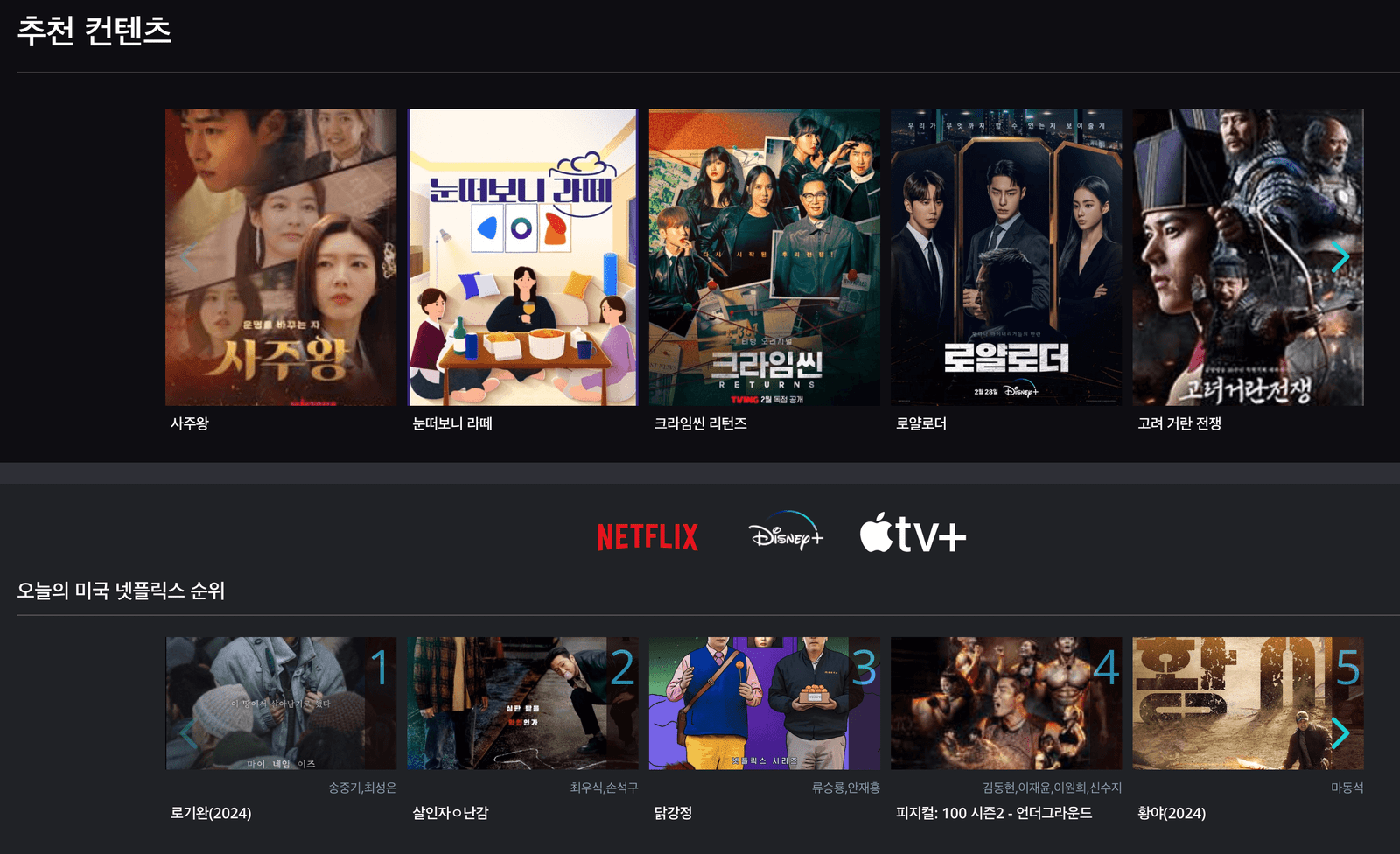

넷플릭스 한국 드라마 추천

넷플릭스 한국 드라마 추천: 한국 드라마는 전 세계적으로 많은 인기를 얻고 있으며, 그 중에서도 넷플릭스에서 제공하는 한국 드라마는 많은 시청자들에게 ...

Read moreHow to Watch Old Movies for Free

Introduction There’s something magical about watching old movies. Whether you’re a film buff or simply curious about the classics, there’s ...

Read moreThe Best Apple TV Series to Watch in November 2023

As we approach the end of the year, it’s time to cozy up and indulge in some binge-worthy TV ...

Read more